Consumption’s share of US GDP currently stands at a sharply elevated 70 per cent. Notwithstanding government life-support initiatives, US consumers seem headed for years of retrenchment. That could happen in the US if Washington continues to favour policies that condone the reckless excesses of the recent past and inhibit the de-leveraging and balance-sheet repair that America’s zombie consumers now need for post-crisis healing. Japan crossed that line in the 1990s, as its corporate zombies prevented the painful but necessary adjustments in its post-bubble economy. But a fine line separates it from the “creative destruction” that is essential to purge a post-crisis system of its excesses. Going well beyond the requisite extension of unemployment-insurance benefits, the safety net has been expanded to include home-foreclosure containment programs, other forms of debt forgiveness, and extraordinary monetary and fiscal stimulus.Ĭompassion is part of the moral fabric of any society. Yet the US government has tried virtually everything to prevent consumers from adjusting.

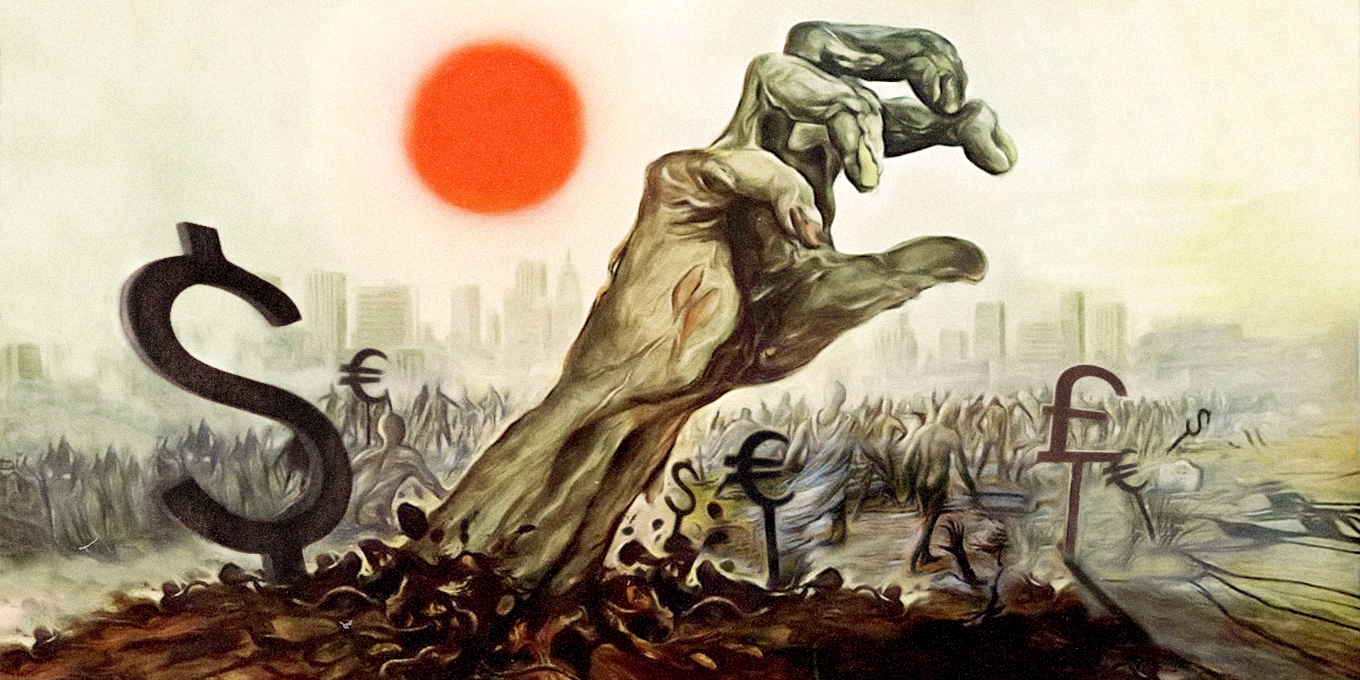

How different is that from Japan’s mindset nearly 20 years ago?īut the most prominent zombie may well be a broad cross-section of American consumers who are still suffering from the ravages of the Great Recession.Īfflicted by historically high unemployment, massive under-employment, and relatively stagnant real wages, while burdened with underwater mortgages, excessive debt, and sub-par saving, US consumers are stretched as never before. In the West, the excuse was “too big to fail”. From Wall Street to AIG to Detroit, the US was quick to rescue corporate giants that would have failed otherwise.īritain and Europe did the same, throwing lifelines to RBS, HBOS-Lloyds, Fortis, Hypo Real Estate, and others. Similarly, the crisis of 2008-2009 led to zombie-creating bailouts in the West. Sclerotic companies were put on life-support credit lines by their zaibatsu – like banking partners – delaying their inevitable failure and perpetuating inefficiencies and disincentives that resulted in a post-bubble collapse in Japanese productivity growth. Japan’s corporate zombies were at the epicentre of its first “lost decade” in the 1990s. Of course, this is not the first time that Asia has had to cope with the walking economic dead. A post-crisis generation of “zombie consumers” in the United States is likely to hobble growth in global consumption for years to come.Īnd that means that export-led developing Asia now has no choice but to turn inward and rely on its own 3.5 billion consumers. Asian markets search for a new model consumer after the American economy tanked, which has yet to recover Īsia needs a new model consumer.

0 kommentar(er)

0 kommentar(er)